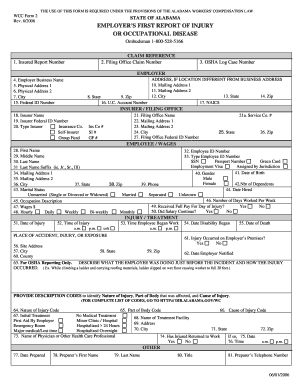

Who uses the WCC Form 2?

An employer, whose employee sustained an industrial injury as a result of an incident, should use this form to report the injury or occupational disease.

What is the purpose of the WCC Form 2?

The WCC Form 2 is a first report of injury or occupational disease.

When is the WCC Form 2 due?

The form must be submitted within 10 days after the date of receipt of notice of knowledge of death or injury.

What information should be provided?

The employer should provide the following information.

Section Employer: employer’s business name, physical and mailing addresses.

Section Insurer/Filing Office: Insurer’s name, federal ID number, type, filing office name, mailing addresses, filing office federal ID number.

Section Employee/Wages: employee’s full name, ID number, SSN, passport number, mailing addresses, gender, date of birth, number of dependents, marital status, date when hired, occupational description, number of working days per week, wages.

Section Injury/Treatment: date of injury, time of injury, time the employee began work, date disability began, date of death, place of accident, injury or exposure, description of the work the employee was doing just before the accident and how injury occurred, description codes to identify the nature of injury, part of body that was affected, and cause of injury, information about initial treatment, name and address of the treatment facility, name of physician or other health care professional. The employer has to answer whether the employee has returned to work, date and time of return.

Section Other: date of the form preparation, the preparer’s name, title and telephone number.

Where do I send the WCC Form 2?

The WCC Form 2 must be sent to the employer’s worker’s compensation insurance carrier and to the Worker’s Compensation Commission.